We help you find trustworthy, 100% verified and daily updated jobs in Dubai, Qatar and the Gulf.

Are you seeking employment that offers better pay, a free visa, or career advancement in Saudi Arabia, Qatar, Oman, or the UAE?

We post genuine, confirmed jobs from reputable companies.

For part time jobs in Dubai Apply Now

For Qatar Jobs Apply Now

Scroll down to explore the latest job openings available

Qatar Airport Jobs – A New Beginning for Those Who Dare to Dream

There comes a time in life when all you want is a chance. Not something big. Just a simple opportunity to work with dignity, to earn honestly, and to bring peace and support to your family.

For thousands of people from places like Nepal, India, Bangladesh, the Philippines, and Africa, that chance often begins with a job at the airport in Qatar.

These jobs may seem small to some — cleaning, handling luggage, pushing trolleys, driving, helping passengers — but for those who take them, they mean everything. They mean the first time sending money home. The first time sleeping in a room without worrying about rent. The first time calling your parents and saying, “Don’t worry about me; I’m okay.”

Qatar airport jobs offer more than a monthly salary. They offer a fresh start. With a free visa, free ticket, free accommodation, and transport, you are not just saving money — you are starting a journey without the heavy cost most people carry.

You do not need a degree. You do not need perfect English. What you need is heart. Willingness. Respect for work. And that is enough.

The world inside an airport teaches you many things. You learn to help people. You learn to be part of a team. You grow. Slowly, but surely. And sometimes, that small job becomes the ladder that takes you to something much bigger — a better position, a more stable life, a future you never thought possible.

This is not just a job in Qatar for foreigners. It is a story waiting to be written — your story.

So if you’re reading this and wondering if it’s worth it — if all the hard work, distance from home, and sleepless nights will mean something — the answer is yes.

One honest job can change everything. And that job might be waiting for you, right now, at the airport in Qatar.

Top International Schools in Qatar Are Hiring – Start Your Teaching Journey Today

If you’re a teacher, you probably know how it feels to give everything in the classroom and still wonder if it’s enough—financially, emotionally, and professionally. That’s something many of us go through. But if you’ve ever thought about working abroad, Qatar might be exactly what you need.

I’m saying this not just because the pay is good (it is), but because teaching in Qatar comes with something we don’t always get—respect. Schools here treat teachers like professionals. You’re supported, you’re trusted, and you’re given the tools to actually teach, not just survive your day.

The salary is tax-free, which means you actually take home what you’re offered. Most schools also cover your accommodation or give you a housing allowance. Flights home every year? Covered. Health insurance? That too. And at the end of your contract, you’re often given a bonus as a thank-you for your service.

Jobs are open across the board—whether you teach English, Science, Math, or early childhood. They also need counselors, admin staff, even librarians. If you’ve got a teaching qualification, some experience, and the courage to take a leap, you’re already a strong candidate.

Life in Qatar is calm, safe, and surprisingly modern. Doha is full of people from every part of the world, and there’s a balance here that’s hard to find elsewhere—work, life, peace of mind.

Latest 5-Star Hotel Jobs in Qatar with Free Visa and High Salary

Have you ever pictured yourself at a lovely five-star hotel, where everything seems professional and great? This could be the chance you have been waiting for if you are someone who want to work in a respected location and create a brighter future.

A luxury hotel in Doha, Qatar is presently recruiting. They want kind, diligent, honest individuals to join their team. You need not be flawless or have decades of expertise. What they seek is commitment, decent manners, and a desire to learn. Whether this is your first time or you have experience in a hotel, there is a place for you.

From front desk and cleaning to culinary workers, servers, cooks, and even assistance, there are several occupations available. Starting at QAR 2,500 and rising to QAR 9,000 depending on your abilities and the work function, salaries are reasonable and consistent.

But it’s not only about the pay. You will also receive medical insurance, transportation, complimentary meals, and free lodging. Your aeroplane ticket will also be covered. Like the law in Qatar says, you will receive paid vacations and incentives. That allows you to work, save, and yet look after yourself.

The best thing? There are no agency costs to you. Simply complete the application procedure and provide your information honestly and clearly. It’s easy and every week folks are being chosen.

Many individuals are looking for honest employment with decent pay and safe surroundings, we know. This might be your moment—a chance to create something for yourself and your family and labour with respect.

Therefore, don’t delay. Start moving towards something better. Apply right away; your future could be just around the corner in Qatar.

High-Paying Cybersecurity & IT Jobs in Dubai: Here’s What You Need to Know

If you’re someone who works in tech—or wants to—there’s a quiet wave of opportunity happening in Dubai right now. It’s not loud. You won’t always hear about it on the news. But if you’re paying attention, it’s clear: the city is becoming a serious player in tech, and it’s happening fast.

I’ve had friends in the industry pack their bags and head over there in the last year. Some were cybersecurity analysts. Others were working in cloud systems or general IT support. And nearly all of them found something incredible: companies that are hiring, paying well, and offering real growth—not just in salary, but in career and lifestyle too.

Dubai used to be all about real estate, retail, and luxury. That’s still part of it. But now, it’s also about digital security, cloud platforms, and building infrastructure for a smarter, more connected future. Everyone from hospitals and banks to airlines and government departments is going digital. And when things go digital, they need people who can keep that world safe.

That’s where you come in.

Right now, companies are looking for people who know how to protect systems, manage networks, build secure cloud environments, and respond to cyber threats before they become disasters. The best part? You don’t have to be a senior engineer with 15 years of experience. If you’ve got solid skills, a few certifications, and the willingness to learn fast, there’s space for you here.

I’m not talking about low-tier IT helpdesk roles either. I’m talking about real, high-paying, high-responsibility jobs. Cybersecurity professionals in Dubai are earning anywhere from AED 18,000 to AED 25,000 a month—often more if they’re specialized in ethical hacking or cloud security. Many companies throw in extra benefits too: housing allowance, medical insurance, yearly flights home, even bonuses for completing certifications.

Why the rush in hiring? It’s simple. Cyber threats are no longer just a problem for big tech firms. Smaller companies, logistics providers, banks, and even schools in the UAE are experiencing attacks—and they’re serious about defending themselves. There’s no time for slow hiring cycles. They need people now.

Another thing to know: Dubai’s got a big plan. The government wants the economy to be fully digital by 2030. They’re building AI-powered services, online public platforms, smart cities—the whole package. It’s not some distant dream. It’s happening. And someone needs to design it, build it, and secure it.

You might be wondering, “Do I need to already live in Dubai to get hired?” Not at all. Plenty of companies are open to hiring international candidates. Some will even let you work remotely until your visa is ready. If you’ve got certifications like CEH, CISSP, CompTIA Security+, or even something cloud-specific like AWS Security, you’re already in a strong position.

It helps to tailor your CV and mention the tools and projects you’ve worked on. Real-world experience matters here. If you’ve worked with firewalls, cloud migrations, or security audits, don’t be shy about putting that up front. Dubai companies want people who’ve actually done the work, not just read about it.

Life in Dubai, by the way, isn’t all about work. Sure, you’ll work hard. But there’s a great lifestyle too. Beach days, global food, an expat-friendly community, and sunshine most of the year. There’s also an energy to the city that’s hard to describe—it’s like everyone’s trying to build something at the same time, and you can feel it.

So if you’ve been thinking about making a move—career-wise, location-wise, or both—this might be the right moment. The world’s shifting, and tech is leading the way. In Dubai, that shift is opening doors for people who are ready to step in and make a difference.

Take a look at the listings. Reach out to a recruiter. Brush up your LinkedIn. You don’t have to make the leap overnight. But trust me: once you see what’s happening in Dubai, you’ll want to be part of it.

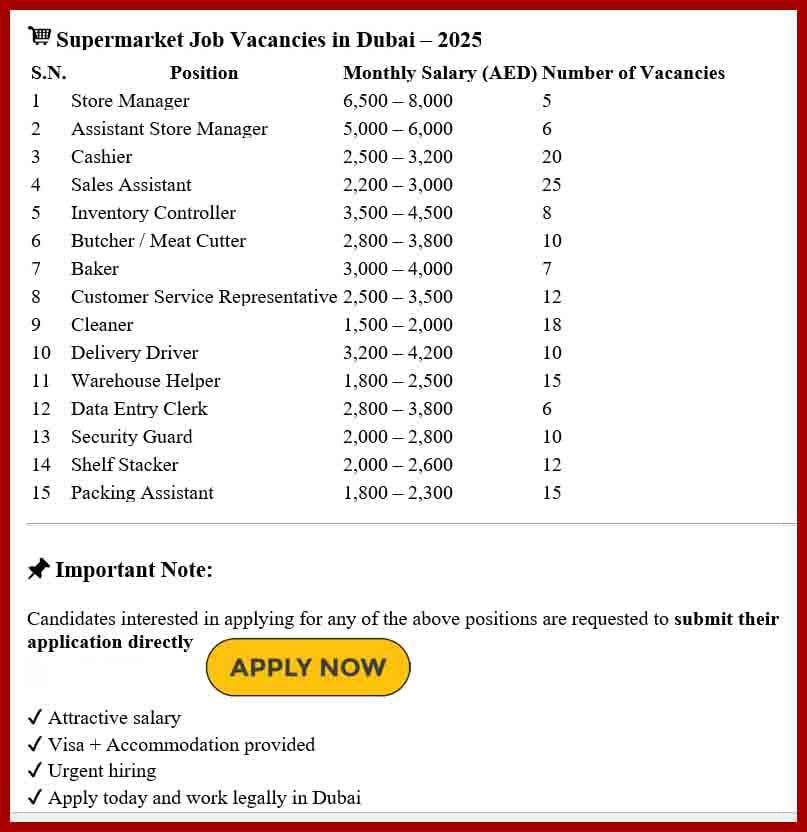

Currently looking for Apply now for high-paying supermarket jobs in Dubai!

Would you like to work in Dubai in a steady and rewarding position? In the United Arab Emirates, Mumtaj Co is pleased to announce several openings at prestigious supermarkets. For several full-time positions, we are actively seeking motivated and talented applicants. With competitive compensation packages and benefits, Dubai offers you the chance to start a steady, tax-exempt career.

Cashier, sales assistant, butcher, cleaner, delivery driver, data entry clerk, warehouse assistant, store manager, assistant manager, and other positions are among the many that we are currently hiring for. In one of Dubai’s most vibrant retail spaces, we serve people at every stage of their careers.

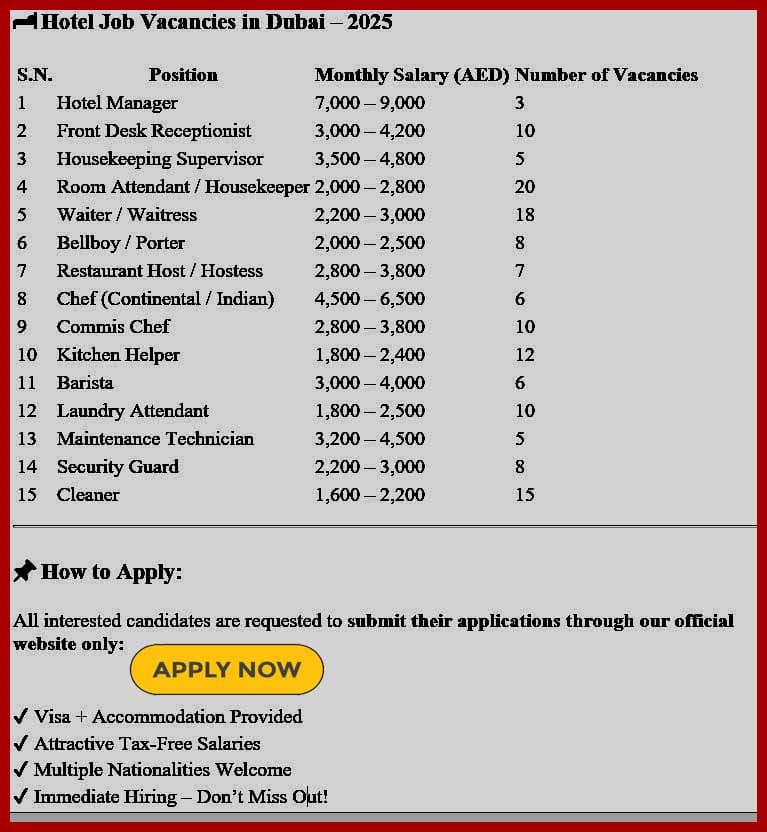

For high-paying hotel jobs in Dubai, please apply now!

Mumtaj Co. is now providing interesting job prospects in leading hotels all around the United Arab Emirates. To help the expanding hospitality industry, we seek committed, service-oriented, and competent people. Your opportunity to create a long-term career in one of the most opulent travel locations and guarantee a consistent, tax-free income is now.

Hotel jobs in Dubai provide more than just work; they provide a lifestyle with reasonable pay, free housing, visa sponsorship, and professional development.

We are now recruiting for several hotel roles, including:

- Front Desk Receptionist-Apply Now

- Cleaning Crew-Apply Now

- Waiters & waitresses-Apply Now

- Room Attendants-Apply Now

- Kitchen Helpers & Commis Chefs-Apply Now

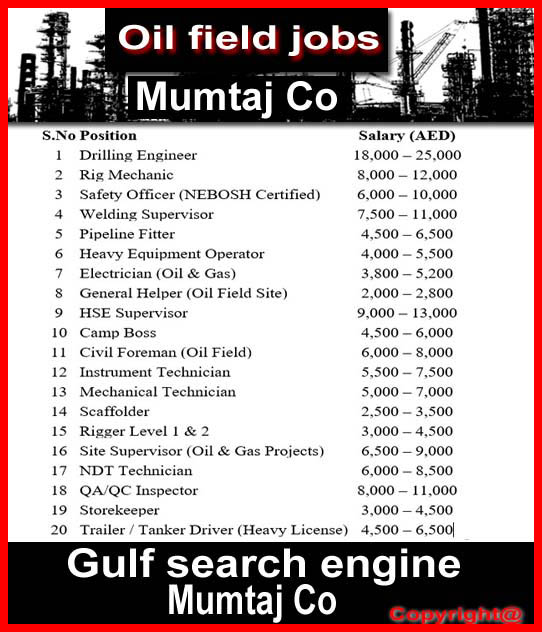

Apply now for high-paying oilfield jobs in Dubai—no fees, a free visa, and a tax-free salary!

Do you fantasise about working in one of the richest sectors of the world? Dubai’s oil and gas industry is thriving; now is your opportunity to participate in it! At present, we are looking for semi-skilled and skilled people to fill several oil field job openings with top-tier energy firms in the UAE.

These jobs provide tax-free income, free visas, housing, medical insurance, and most importantly, great pay. Everyone of all nationalities is welcome to apply.

Why Apply for Oil Field Jobs in Dubai? Depending on role and experience, salary range is AED 3,000 to AED 12,000+

Perks: Free lodging, meals, transportation, and overtime pay.

Sponsored by the business, visa assistance is free for the applicant.

We don’t charge anything for hiring or applications.

Join a stable and expanding sector with long-term contracts for high career development.

How to Open a Bank Account Without Emirates ID in UAE

For new workers, job seekers & residents

Many people from Nepal, India, and other South Asian countries come to the UAE with big dreams. The first few weeks are full of hustle — finding a job, adjusting to the heat, and figuring out how things work. One of the first struggles most newcomers face is opening a bank account. It’s a simple thing, but it becomes a headache when the Emirates ID is still under process.

I’ve seen this happen with many people. You get your visa, you arrive in Dubai or Abu Dhabi, and when you try to open a bank account, they say, “Emirates ID chahiye.” That’s where people start to panic. How will you receive your salary? How will you send money home?

But don’t worry. You can still open a bank account in the UAE without your Emirates ID. It’s not as hard as people think.

Some banks understand that workers and job seekers may not have their Emirates ID right away. Banks like Liv. (from Emirates NBD), Mashreq Neo, RAKBANK, and even WIO Bank offer online account options that work with just your passport and visa. You also need a UAE mobile number and sometimes a proof of where you’re staying — maybe a hotel booking or tenancy contract. That’s it.

If you already have a job offer letter, it becomes even easier. Many banks allow salary accounts to be opened using that letter, along with your passport copy and visa page. So if you’re waiting for your Emirates ID, you can still receive your salary into a proper bank account. No need to depend on friends or unsafe ways.

I always tell newcomers — don’t go to agents. Many people will try to charge you 100 or 200 dirhams, saying they will “help” you open an account. The truth is, you can do it yourself online for free. Just download the bank’s app, fill in the details, and you’re done in a few minutes.

Now, of course, these accounts without Emirates ID might have some limits. You might not get access to credit cards or big transfers at first. But you can still use your debit card, receive a salary, and even send money back home using exchange apps.

Once your Emirates ID is ready, go back to the bank and update your details. Your account will be upgraded, and you’ll have access to full services like loans, international transfers, and more.

So if you’re new in the UAE, don’t stress too much. Getting your Emirates ID might take time, but your money doesn’t have to wait. Open your account, start saving, and take your first step toward stability.

Trust me, I’ve been through it. And now that I know how it works, I always share this with new people arriving. One small account can make a big difference in your journey abroad.

Cheapest Way to Send Money from Qatar to Nepal

Discover the cheapest way to send money from Qatar to Nepal in 2025. Compare rates, apps, and services to save more on fees and get better exchange rates.

If you’re working in Qatar and supporting your family back home in Nepal, one of the most important things you think about every month is how to send money safely — and cheaply. After all, every riyal saved on fees or exchange rate means more support for your loved ones.

There are many options to send money to Nepal, but not all of them are good for your pocket. Some charge high transfer fees, while others give poor exchange rates. I’ve talked to many Nepali workers in Doha, Al Khor, and even Mesaieed who send money every month — and most of them agree that finding the right method can save hundreds of riyals a year.

Let’s be honest. Many people still go to money exchange shops because that’s what they’ve always done. You go there, stand in line, fill out a form, and hand over the cash. But sometimes, the exchange rate is not great, and they charge extra fees. It’s safe, yes, but maybe not the cheapest anymore.

In recent years, online and mobile money transfer services have become very popular. Services like IME Pay, eSewa Remit, Prabhu Money Transfer, and Khalti Remit offer quick transfers from Qatar to Nepal. Some of these platforms have tie-ups with local Qatari exchange houses like Al Zaman Exchange, Lulu Exchange, or Al Dar Exchange. These tie-ups allow you to send money using your mobile, without even visiting the shop.

Another smart option is to use online-only platforms like WorldRemit, Remitly, or Wise (formerly TransferWise). These apps often provide better exchange rates than traditional exchange centers, and some even offer your first transfer for free or at a discounted rate. Plus, they let you compare rates and fees in real time.

Some people also use bank transfers — for example, from Qatar National Bank (QNB) or Doha Bank directly to a Nepali bank account. But this method is only useful if you have a bank account and the receiver has one too. The fee may be slightly higher, and it might take longer.

If you’re sending money to remote areas in Nepal where there’s no bank, many remittance companies offer cash pickup through their local partners. Your family can simply go to a nearby IME or Prabhu branch and collect the cash with just a code and ID.

The best way to find the cheapest option is to compare the exchange rate and the fee together. Sometimes, a company may offer “zero fees” but give a lower exchange rate. Other times, the fee might be 10 QAR, but the rate is so good that you still end up sending more money home.

At the end of the day, what matters is that your money reaches your family safely, quickly, and without wasting riyals on extra charges. Try using apps where you can check the rates instantly, and avoid sending during weekends when exchange rates often drop.

I always say — your hard-earned salary should go to your home, not to fees. A little attention while choosing the service can make a big difference every month.